VATID Validation PRO (SW5)

€495.00*

Available in the Shopware Community Store!

Icon: Self Hosted / Cloud

Icon: Shopware Version (5 / 6)

Kompatibilität: mind. SW 5.x.x

Video

Description

Feature-Request

Installation manual

Changelog

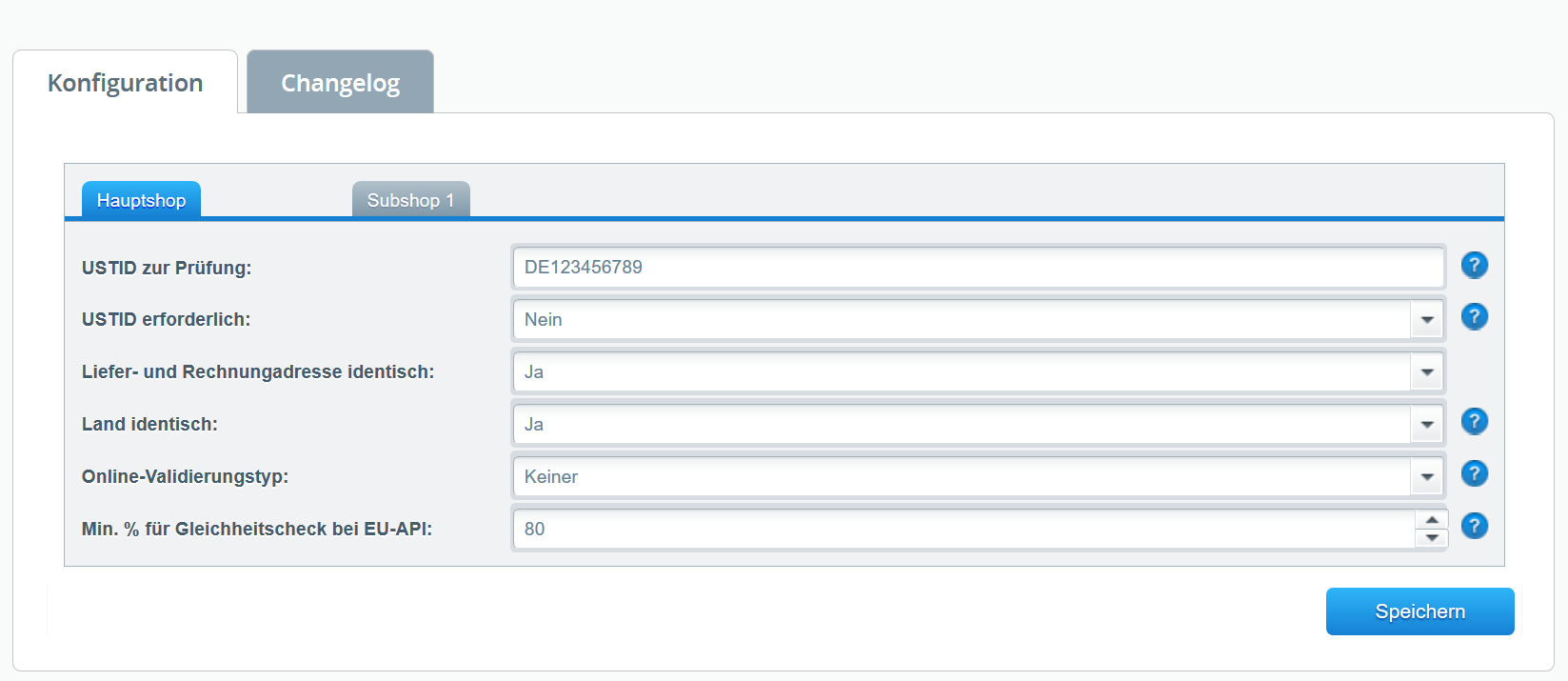

Plugin configuration

No Videos here

With our app "USTID Validation PRO" you can improve the validation of USTIDs in your store.

The VAT identification number is a special tax number used to identify the company. When making business purchases in other EU countries, the foreign VAT will be deducted if the VAT ID number is stated. A company can have the validity of foreign VAT ID numbers confirmed via the Federal Central Tax Office. There are two possible online procedures for this. Via an Internet form and via the so-called XML-RPC interface, which allows companies to integrate the verification of foreign VAT registration numbers into their own software systems and to query the VAT registration numbers automatically. The procedure for confirming foreign VAT registration numbers makes it easier for German companies to check whether, at the time the service is provided, the supply or other service is being provided to a company registered in another EU member state.

The app "USTID Validation PRO" offers numerous functions that are important for you if you frequently trade with EU companies. Below you will get to know the app:

Functions

- Checks VAT ID of companies if country is in EU and country is marked as "Tax free for companies".

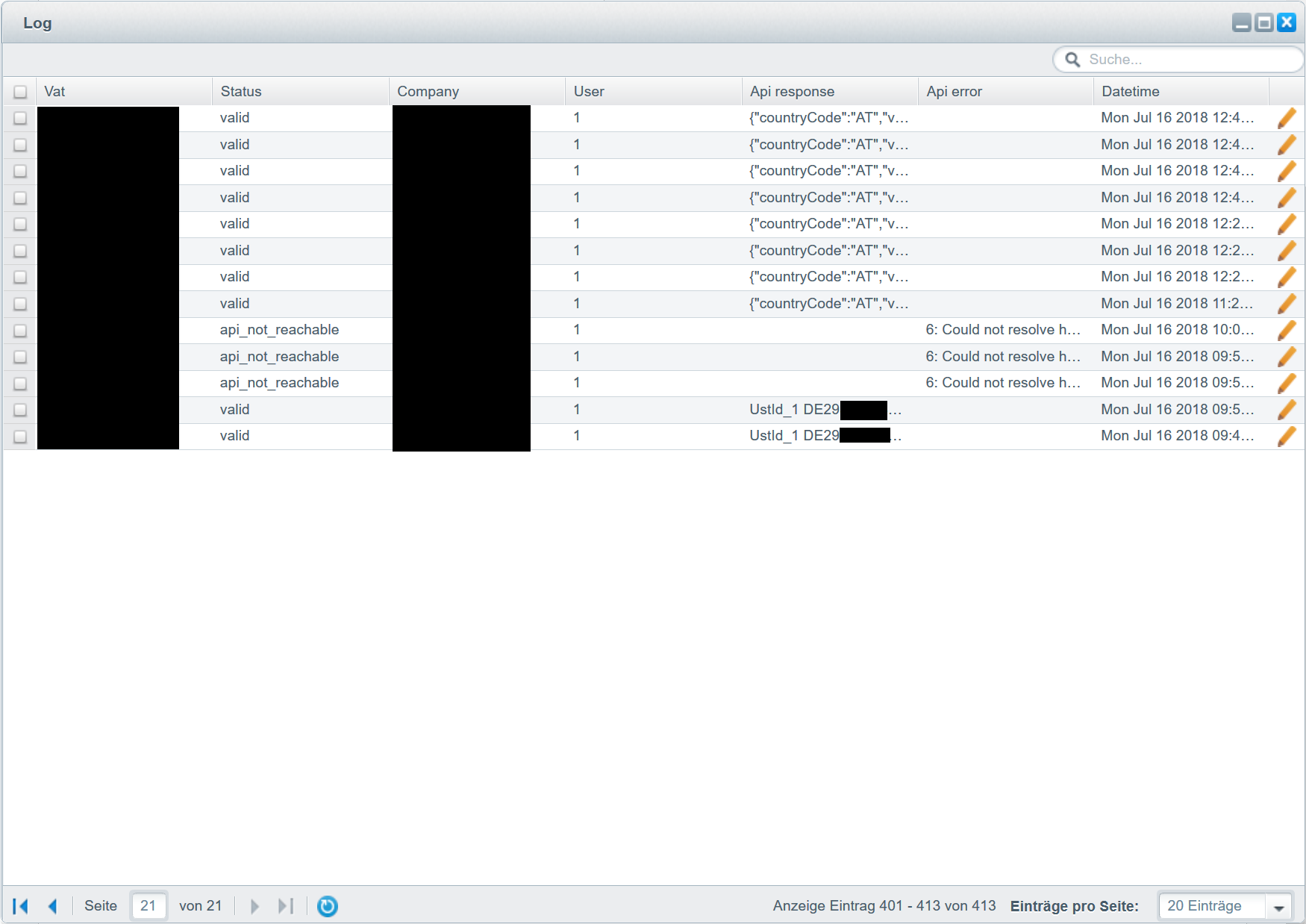

- Every request to an interface is logged and stored in the database. This way you can prove that you have checked the USTID.

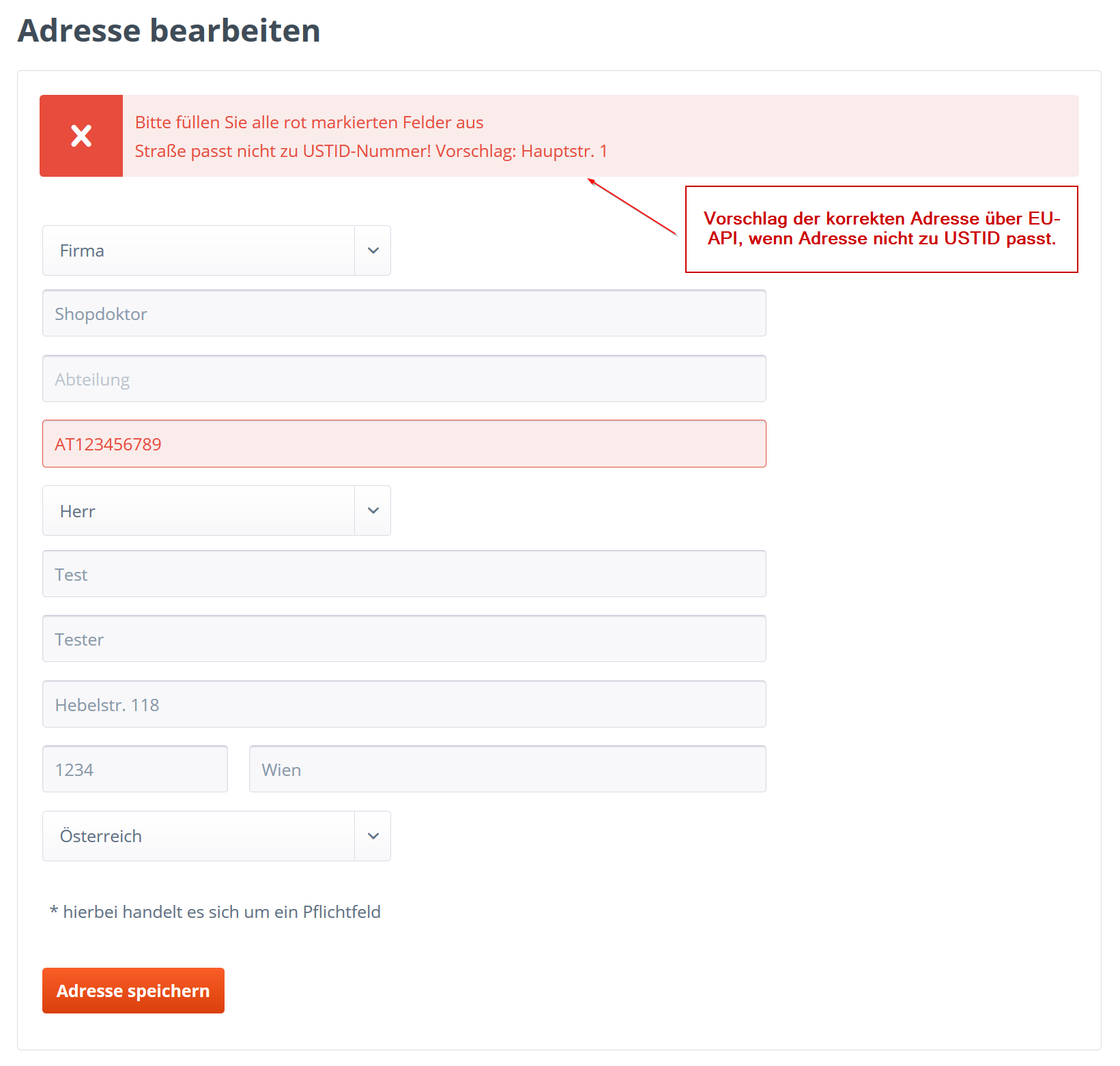

- For each address creation / change that contains a VAT ID, a validation of the VAT ID is performed, provided that the country of the address is in the EU and "Tax free for business" is set.

- When sending each order, the VAT ID is checked again, as it could be invalid in the meantime.

- When sending the order, it is optionally checked whether the delivery and billing address or delivery and billing country are identical.

- Validation can be based on either the shipping address or the billing address.

- Since version 1.0.30: From now on customers can also order with incorrect VAT ID, but then the tax will be calculated. Thus, we prevent purchase cancellations due to deviating data at the tax authorities.

Information to APIs

- Bulgaria: API currently not available (effective 17.12.2018). Always marked as validated when querying the EU API.

- Estonia: No validation of the city via EU API possible.

- Ireland: Zip code cannot be validated via EU API.

- Lithuania: Zip code cannot be validated via EU API.

- Romania: Zip code cannot be validated via EU API.

- Spain: (Validation only possible from version 1.0.23. No address suggestions possible).

- Germany: Only USTID validatable. Name, street, postal code and city not validatable.

Please ask your tax advisor how you have to keep your documents for the tax authorities. We do not assume any liability for this.

Requirements

- php-soap

- php-xml

| Compatibility: | min. 5.6.x.x |

|---|---|

| Shopware Version: | Shopware 5 |

| Useable in: | Self-Managed |

Enter your VAT ID here so that our app can check the VAT IDs of your customers.

Activate this option if corporate customers in EU countries have to deposit a VAT ID.

Specify whether your customers can place an order with VAT if the VAT ID validation is invalid.

To prevent foreign customers from providing a company's VAT ID and then shipping to their private address tax-free, you can enable another check that prevents this.

If you have set the option "Delivery and billing address identical" to No, you can check instead whether at least the delivery country of the delivery and billing address is identical.

There are the online validation types "None", "Simple" and "Advanced". With "None", only the offline plausibility check is performed. Simple" checks whether the VAT ID is valid. With "Advanced" it will be checked if VAT ID and address match.

First, the German API is always tried to be reached. If the German API returns an incorrect result, the EU API is requested. Here you can determine how high the match with the data of the EU API must be. Recommended are 100%.

Translate suggestions to latin alphabet

API Timeout

Specify whether the shipping or billing address should be used as basis for validation.

Northern Ireland only taxfree with vat id

- Install and activate the extension.

- Store your settings in the configuration

- Done.

- Countries to be validated must be marked as "Tax free for business" and have the official ISO-2 country code on file.

- The extension does not work with Paypal "In-Context Mode".

BUGFIX | Updated SE validation pattern for EU API.

IMPROVEMENT | If relevant country is "tax free", no tax is calculated (without vat id check!).

IMPROVEMENT | Added Option: MIAS vat approx: Use "not processed" as invalid.

BUGFIX | Zipcode exception in ExtendedMiasValidator adjusted.

BUGFIX | Changed escaping in ExtendedMiasValidator.

BUGFIX | Paypal In-Context orders are now blocked correctly.

BUGFIX | Same address check failed with different addresses buy same content.

IMPROVEMENT | Added option for Northern Ireland handling. (has to be activated)

IMPROVEMENT | Added validation for XI (Northern ireland).

IMPROVEMENT | Updated detection of SI-address data.

IMPROVEMENT | Country identical and address identical were not shown correctly.

IMPROVEMENT | New option to allow blocking of order (/checkout/confirm), if vat id is invalid.

BUGFIX | Taxfree was not correctly calculated with empty vat id.

IMRPOVEMENT | Added configuration to select if shipping or billing is the relevant address for taxfree delivery

IMPROVEMENT | VAT ID in shipping address is now determining if delivery can be taxfree.

IMPROVEMENT | Plugin refactored. Orders with tax are now allowed with wrong tax.

ATTENTION: The behaviour of the plugin has changed with version 1.0.30. From now on, customers can also order with an incorrect USTID, but the tax will then be calculated. Thus, we prevent purchase cancellations due to deviating data with the tax authorities.

If you have any questions, please contact support@lenz-ebusiness.de BEFORE the update.

IMPROVEMENT | Support for Shopware 5.7..

IMPROVEMENT | Added option to check vat id already on checkout/confirm-page.

IMPROVEMENT | Added new API response to responses, that are marked as API not reachable.

TASK | Removed GB because of Brefix.

TASK | Removed option "Extended + Confirmation", because it is not allowed anymore.

Please check and set option "Online validation type" after updating.

IMPROVEMENT | France-EU-API-Validation ignores parts of address that are not relevant.

Bugfix for option "Vat id required:"

Notice: Countries that should be validated, needs to have set "taxfree for companies" set and needs to have the correct ISO-2-Country-Code.

- Spain will be checked again.

- Better GB-vat-id checking

IMPROVEMENT | Belgium EU REGEX

IMPROVEMENT | Added english translations

IMPROVEMENT | Default value of "Min % for similarity check on EU-API" to 100.

IMPROVEMENT | German vat id check validates A and D as valid instead of not B.

Plugin can now be disabled per subshop.

Fixes a bug that prevented new addresses in backend from being saved.

Fixes a problem with registration and alternative delivery address if vat id is required.

Fixes a bug that prevents addresses in backend from saving

- Improvement: CZ-validation in EU-API optimized

- Improvement: BE-validation in EU-API optimized

- Improvement: GB-validation in EU-API optimized

- New: Transliterating letters in EU-API-Validation and suggestions can be enabled via setting.

- Improvement: Added ignored characters for EU-API-Validation

- New: API-Timeout is now configurable

- Excluded Spain from EU-API-Validation because results are not reliable

- New: Added backend rights for log view.

- New: Check if vat id is only in delivery address. If yes: notice!

- New: Taxfree delivery only if vat is is in billing address.

EU-API:

- Better error logging

- Validation for FR-addresses improved

- Corrected error in vat logic

- Implemented better validation of eu-api-data

IMPORTANT: Please install this update.

- vat id saved in uppercase and without special chars

- calculating vat if customer address is same country as merchants vat id

- german vat ids are now validated (only simple check)

- api change of german api. please update now.

Shopware 5.5 compatibility.

- Better error handling for german api

- External payments are now supported, too.

SQL-Bugfixes for not-logged-in users.

Better VATID-validation-process.